What You Should Know About Regional Jet Pilot Jobs

Regional Airline hiring ads often use them – pictures of sleek, new looking jets. They try to evoke the passion of would-be and new professional pilots, showing a lifestyle of flying a shiny new jet around the country.

Regional Jets have brought about significant change in the airline industry. Dreamed about by aspiring pilots and sometimes scorned by experienced pilots for the lasting impact the jets have had on the pilot hiring system. This article will explain the what and why of regional jets and the impact they have had on pilot jobs.

In a Class Of Its Own

With the passage of airline deregulation in 1978 opportunities appeared for United States airlines to link city pairs that had not previously seen affordable service. Airlines began using turboprop aircraft to feed passenger service into hubs. But turboprops were too slow to serve within this burgeoning hub-and-spoke system on routes longer than 300 miles and existing mainline jets had too many seats to profitably serve smaller communities.

Regional jets are not a new concept. Early regional jets included the Fokker F28, BAC One-Eleven, Yak-40, and BAe 146. However, it was the Canadair Regional Jet, introduced in 1992, that ended up being the right airplane at the right time. The CRJ-100 was designed to bridge the gap between the short haul turboprops and existing single-aisle jets and it would go on to transform the airline industry in the United States. The first CRJ entered service with Lufthansa CityLine. In the United States Comair and Skywest Airlines were the first to use the new type.

Bombardier introduced a new variant of the CRJ in 1996 with the CRJ-200. The airplane was the same size as its predecessor but featured more powerful engines and improved systems. 1996 was also the first year that Bombardier faced competition in the regional jet sector when Embraer introduced the ERJ-145. Embraer would go on to create derivates of the ERJ-145 both in size and range.

Regional Jets Get Bigger

Bombardier followed the success of the CRJ-200 by launching the 70-seat CRJ-700 in 1997. They launched the 90-seat CRJ-900 in 2000 and the 100-seat CRJ-1000 in 2007. The larger airplanes varied significantly from the earlier regional jets in both design and in increased collaboration for production.

Embraer introduced the clean sheet E-Jet family in 2004. The all-new airplanes featured 4 variants. The smaller E-170 and E-175 are flown by regional airlines while the larger E-190 and E-195 are typically operated by mainline airlines. The first E-170 entered service with LOT Polish Airlines in 2004. The first E-190 entered service with JetBlue Airways in 2005.

Regional Jet Economics

A defining metric for airline operations is cost per available seat mile (CASM). CASM measures the cost to move one seat one mile. As an example, if a 50 seat jet and 90 seat jet had the same hourly operating cost the 90 seat jet would have a lower CASM due to having more seats to distribute that cost over.

Prior to 2001 airline customers were less price sensitive and were willing to pay more to fly on legacy carriers. Innovations after 2001 allowed customers to shop for airline tickets as a commodity and they became more cost conscious. In this environment the service differentiation between low cost carriers and legacy carriers narrowed and legacy carriers began to focus on reducing CASM across their route structures.

In this cost-cutting environment the cost per available seat mile for outsourced regional operations was reported to be similar to low cost carriers. This gave airline managers justification for replacing legacy mainline operations with regional jets as well as the expansion of service the smaller jets allowed.

As larger regional jets were introduced and mainline flying was being replaced by regional jets, the compensation gap narrowed between regional airlines and mainline employees. This occurred as regional pilot pay increased and legacy airline pilot compensation decreased. Additionally, fuel cost increases further increased the cost per available seat mile of small regional jets relative to the mainline narrow body airplanes they were replacing.

Quarterly financial reports from airlines who employee regional carriers often show the CASM for the regional jets up to 50% higher than the cost per available seat mile for the carrier’s own narrow body jets. But continuing with the increased cost of the regional jets is justified by higher revenue per available seat mile (RASM) that can be generated in the regional operations. This higher revenue is evident in higher ticket prices in communities served by regional operations.

| Cost Per Block Hour | Cost Per Available Seat Mile | Average Daily Utilization | |

|---|---|---|---|

| Turboprop | $1,793 | 9.1 cents | 7.3 hours |

| Small Regional Jet | $1,304 | 10.2 cents | 6.4 hours |

| Large Regional Jet | $1,389 | 6.1 cents | 8.6 hours |

| Mainline Small Narrowbody | $3,624 | 7 cents | 9.8 hours |

| Mainline Large Narrowbody | $3,859 | 5.6 cents | 10.7 hours |

| Mainline Widebody | $7,580 | 6 cents | 12 hours |

Reduced Flexibility

Carriers with large outsourced regional jet operations are more vulnerable to market factors. The cost of fuel for regional jets is often higher per available seat mile. When fuel prices spike these carriers have a greater increase in costs.

After the economic downturns in 2001 and 2008 some airlines were able to rapidly reduce capacity in response to the downturn by parking airplanes and laying off employees. Carriers that have contracted out operations to regional airlines cannot easily get out of the agreements with the regional carriers and are stuck with the capacity they have contracted for.

Pilot Scope Clauses

Pilot scope clauses are agreements between pilot unions and the employers specifying which work will be performed by the represented pilots, and also defines exceptions where employers can outsource work to non-represented pilots.

Prior to the spread of regional jets the exceptions rarely got much attention. After the explosion of the regional airline industry in the United States the exceptions portion of labor contracts led to significant tension between mainline pilot unions and their employers.

Pilot scope clause battles have come to define the airline industry over the last two decades. The progression of these battles between pilot unions and pilot employers are influenced by three significant factors.

- Current negotiation landscape between pilots and their employers.

- In contract negotiations there is a certain amount of leverage each side brings to the table. As an outside influence, the labor market can influence the leverage position between the two sides. The desire of an employer to outsource work to regional airlines, the pilot union’s perceived threat to losing work to outsourcing, and the price required by the pilots are driving factors in unions allowing a relaxing it scope protections (also known as scope relief).

- The gap between the largest aircraft allowed to be outsourced and the smallest mainline airplane.

- This is caused by an airline outsourcing the largest airplane allowed by scope clause and the lower labor rates of that outsourcing. Due to the lower cost per available seat mile from the lower labor cost it requires a larger airplane at the mainline level to match the CASM of the regional jet. As a result the smallest mainline airplane is typically 30 to 50 seats larger than the largest airplane allowed to be outsourced.

- Misalignment of scope causes which cause a leap-frog tendency.

- When unions and airlines negotiate an amended contract the status of union contracts at competing airlines will come in to play. When another pilot group agrees to reducing scope protections it becomes difficult for the current

negotiating union to maintain position on their existing scope clause.

In an environment where scope relief is generally sought by employers the existing negotiating pilot group will often relax their scope agreements more than the previous pilot group did in an effort to gain something else. This can create a cycle of leap-frogging in the industry which can cause a significant shift in employment for pilots from mainline flying to regional airline flying.

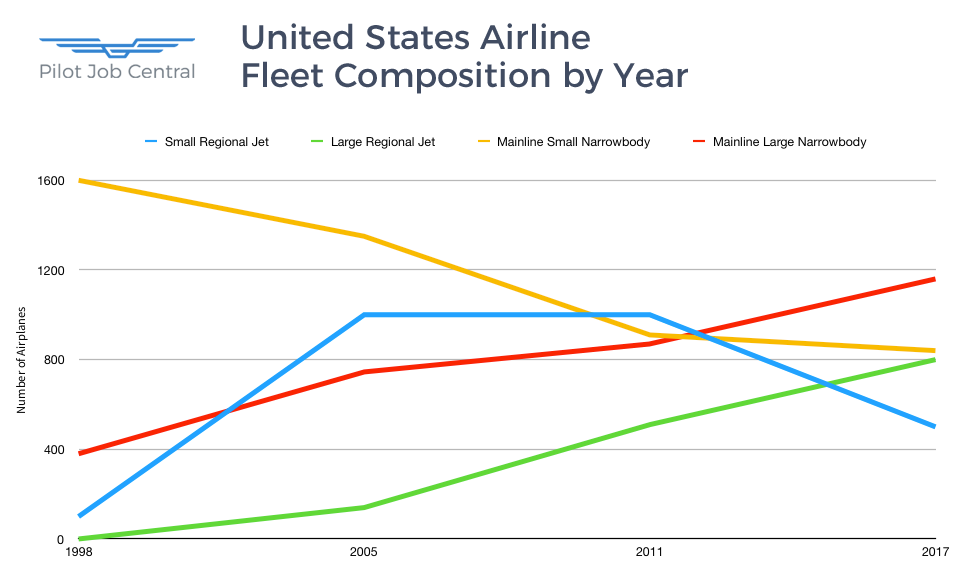

Regional Jet Proliferation

Less than half a decade after the introduction of the first Bombardier regional jet the airline industry began realizing the potential of the airplane type. Mainline pilots during this time were content with their long-standing scope protections which had been sufficient enough to prevent threats from regional airlines and were more focused on merger protections, pay, and benefits during contract negotiations. In this environment scope clause relaxation came easily and cheaply for airlines.

Prior to 2005 the 50 seat regional jet fleet grew at a fast pace. The Bombardier CRJ700 entered service in 2002 though wasn’t common with regional airlines for a while. Prior to 2005 most mainline scope clauses limited outsourced flying to airplanes with 50 seats or less. Many of the airlines over-ordered 50 jets to compensate for the larger regional jets they would have preferred.

Following 2006 airline bankruptcies and mergers caused a significant change in scope protections. Several legacy carriers reorganized under Chapter 11 bankruptcy around this time and changed scope agreements through forced labor renegotiations. Pilot groups during this time viewed the threat as significant in the changing scope clauses, however, it mattered little as the bankruptcy reorganization allowed carriers to impose contract terms.

Through the scope changes the Bombardier CRJ700 and CRJ900 as well as the small Embraer E-jets began to proliferate across U.S. regional airlines. These new larger regional jets replaced both mainline flying as well as many smaller 50 seat regional jets.

Return of Pilot Scope Protection

There were originally seven mainline airlines that were influencing the pilot scope landscape. By 2013 only three of these airlines remained. The remaining airlines were now profitable and mainline pilot groups continued with a strong desire to regain lost work.

It took the pilot unions only one contract negotiations cycle to effectively end scope creep. During the United-Continental merger the new airline adopted the Delta scope clause. The American-US Airways merger also saw the new company adopt the Delta scope clause. Even Alaska Airlines, which did not previously have a defined scope agreement, voluntarily adopted the Delta scope clause. With all major players having the same scope protections, airline managers lost negotiation leverage pertaining to scope agreements.

The industry standard pilot scope protection limits outsourcing to airplanes having 76 seats or less. And even more limiting, a new standard was introduced limiting airplanes to 86,000lbs or less. Pilot groups had become concerned with regional jets increasing in range capability – thus encroaching on the desirable longer legged flights. The weight limit effectively puts a cap on range capabilities of regional jets used in outsourced flying.

As part of the changing scope landscape pilot groups, for the first time, addressed the amount of 50 seat jets allowed in outsourced work. The is now a limit on the amount of 50 seat regional jets allowed in outsourced flying, and in some cases this caused the mainline carrier to have to reduce its existing 50-seat fleet.

New Regional Jets

Embraer E-Jet E2

The E-Jet E2 family is the successor to Embraer’s original E-Jet family with a target goal of 16-24% fuel savings and 15–25% lower maintenance cost per seat versus the original airplanes.

The new E-Jet E2s are based on the first generation E-Jets with new landing gear, engine pylons, horizontal stabilizer, fly-by-wire flight controls, cabin improvements, updated avionics, and a redesigned wing. The new airplanes are equipped with Pratt & Whitney geared turbofan engines.

The larger E190 and E195 have been operated by mainline airlines in the United States. The largest operator, JetBlue Airways, recently placed an order for Airbus A220 to replace their existing E190s. There aren’t any other major operators of the larger E-Jets in the United States.

The smaller E175 has been a popular airplane with regional airline operations in the United States. However, the new variant of the airplane will exceed the 86,000 lbs maximum takeoff weight set by the now standard scope protection. The airplane could have it’s max takeoff weight artificially reduced in order to pass the limitation. This limitation would severely reduce the range of the airplane and make the airplane have little more capability than modern turboprops.

Bombardier Updates

Bombardier has updated the larger CRJs to include minor aerodynamic improvements with a small fuel efficiency increase. The new variants feature an significant upgrade to the passenger cabin that the manufacturer markets as “Atmosphere.”

The updated CRJ900 is the largest airplane to stay under the standard pilot scope weight limit. It has seen renewed interest with orders from American Airlines and Delta.

Mitsubishi MRJ

The Mitsubishi Regional Jet (MRJ) is a family of two new designs, the MRJ70 and larger MRJ90. Both airplanes feature the new Pratt & Whitney geared turbofan.

The larger MRJ90 exceeds the 86,000 lbs limited max takeoff weight for regional airline operations. The smaller MRJ70 falls under scope limitations and can be used by regional airlines. However, the MRJ70’s seating capacity is not considered ideal compared to the E-175 and CRJ900 and the manufacturer is considering alternatives to make the airplane more attractive to United States airlines.

The MRJ series had previously received several orders by U.S. regional airlines prior to new scope limitations being set. The manufacturer will need to consider concessions to the airlines along with allowing them to convert firm orders for the larger MRJ90 to smaller MRJ70 in order to keep the airplane viable within the current regional airline market.

CRJ Cargo Conversion

As CRJ100 and CRJ200s are being retired from airline service they are finding new life in secondary markets. One major project involves converting the jets into dedicated cargo airplanes.

The CRJ100SF/CRJ200SF are converted from used passenger versions of the small regional jet by Aeronautical Engineers, Inc. (AEI) in Miami. Gulf & Caribbean Cargo was the first operator to take delivery of the cargo version of the airplane in 2016.

Aeronautical Engineers, Inc. says they have received 45 firm orders for the cargo conversion and expect the market to support 100 airplanes over the life of the program, with most being operated in charter service.

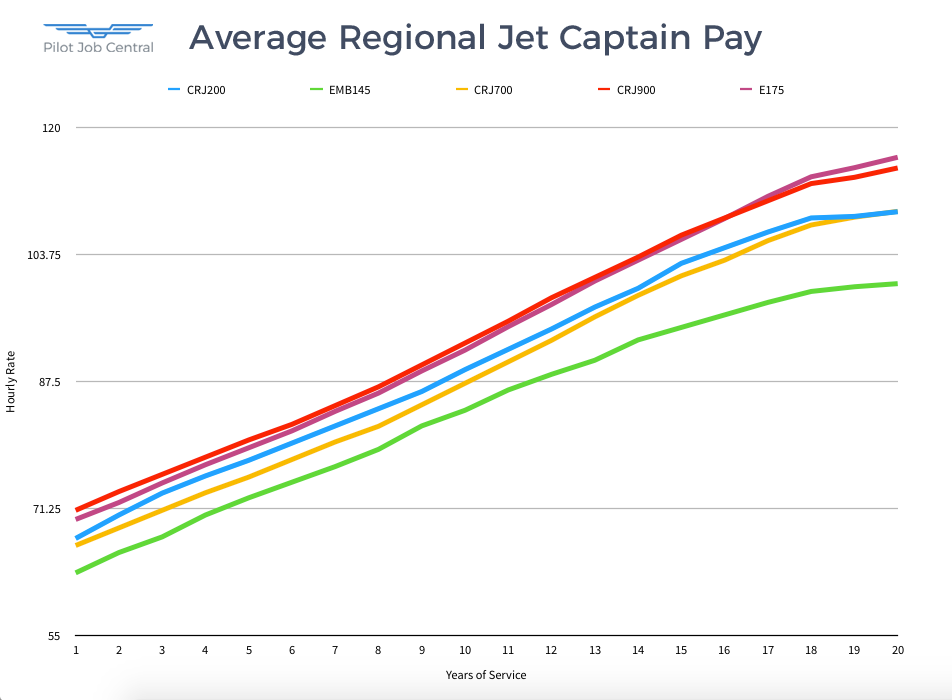

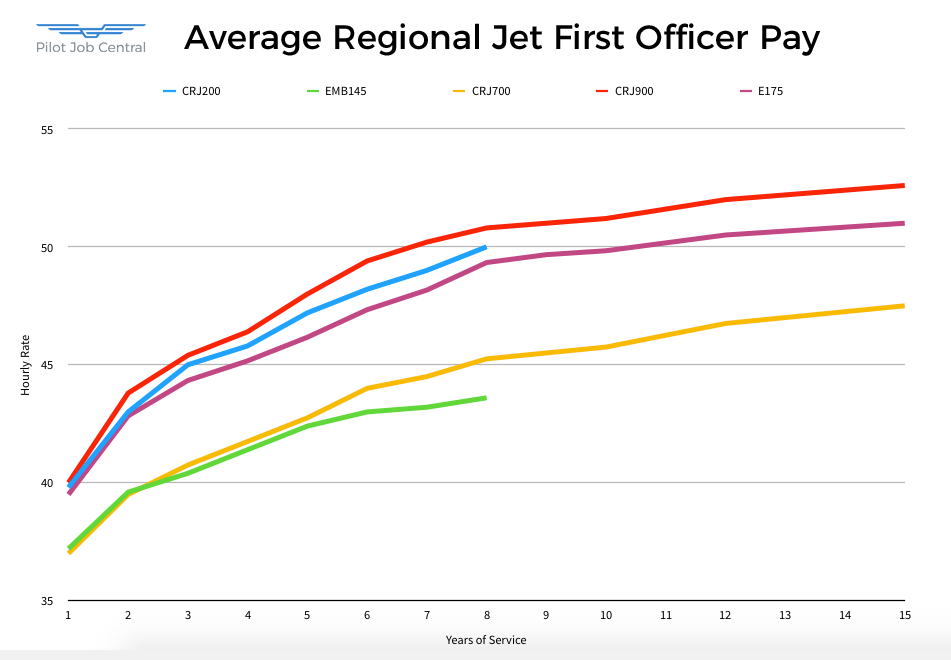

Regional Jet Pilot Pay

The way pilots are paid in the airline environment is more complicated than how pay is determined in other industries. However, a good rule of thumb is to take the hourly rate and multiply it by 1,000 to get the yearly estimate for a position.

Regional airline positions are considered a stepping stone for most pilots working their way through an airline pilot career. Regional jet pilot pay is below what a pilot would expect to get paid flying narrow body airplanes for a major airline. The salary is only part of the consideration though as mainline pilots often have better benefits, better retirement, better work rules protecting their quality of life, and better accommodations while working.

Outside of flying in a traditional airline environment, contract positions are available to experienced regional jet pilots. These positions are used to staff operations overseas and typically have higher salaries than U.S. airline flying.

Regional Jet Captain Pay

CRJ200 Captain Hourly Rate

| Years of Service | Endeavor Air | Express Jet | PSA Airlines | Air Wisconsin | Skywest Airlines | Average |

|---|---|---|---|---|---|---|

| 1 | 84 | 58 | 65 | 67 | 63 | 67.40 |

| 2 | 86 | 62 | 68 | 70 | 66 | 70.40 |

| 3 | 88 | 66 | 70 | 73 | 69 | 73.2 |

| 4 | 90 | 68 | 73 | 75 | 71 | 75.40 |

| 5 | 92 | 70 | 75 | 77 | 73 | 77.40 |

| 6 | 94 | 72 | 77 | 80 | 75 | 79.59 |

| 7 | 96 | 74 | 79 | 82 | 78 | 81.8 |

| 8 | 98 | 76 | 81 | 85 | 80 | 84 |

| 9 | 100 | 79 | 83 | 87 | 82 | 86.2 |

| 10 | 103 | 81 | 86 | 90 | 85 | 89 |

| 11 | 105 | 84 | 88 | 93 | 88 | 91.59 |

| 12 | 107 | 86 | 91 | 96 | 91 | 94.2 |

| 13 | 111 | 89 | 94 | 98 | 93 | 97 |

| 14 | 113 | 91 | 96 | 101 | 96 | 99.4 |

| 15 | 117 | 94 | 99 | 104 | 99 | 102.6 |

| 16 | 117 | 97 | 101 | 106 | 102 | 104.6 |

| 17 | 117 | 99 | 103 | 109 | 105 | 106.6 |

| 18 | 117 | 101 | 105 | 111 | 108 | 108.4 |

| 19 | 117 | 101 | 105 | 111 | 109 | 108.6 |

| 20 | 117 | 101 | 105 | 111 | 112 | 109.2 |

EMB145 Captain Hourly Rate

| Years of Service | CommutAir | Express Jet | Envoy Air | Piedmont | Trans States Airlines | Average |

|---|---|---|---|---|---|---|

| 1 | 64 | 63 | 65 | 58 | 65 | 63 |

| 2 | 66 | 65 | 67 | 63 | 67 | 65.59 |

| 3 | 67 | 67 | 69 | 65 | 70 | 67.59 |

| 4 | 69 | 69 | 71 | 71 | 72 | 70.40 |

| 5 | 71 | 71 | 73 | 73 | 75 | 72.59 |

| 6 | 72 | 73 | 75 | 76 | 77 | 74.59 |

| 7 | 74 | 74 | 77 | 79 | 79 | 76.59 |

| 8 | 76 | 76 | 79 | 82 | 81 | 78.8 |

| 9 | 78 | 79 | 82 | 86 | 84 | 81.8 |

| 10 | 80 | 81 | 84 | 88 | 86 | 83.8 |

| 11 | 82 | 83 | 87 | 91 | 89 | 86.4 |

| 12 | 84 | 86 | 89 | 93 | 90 | 88.4 |

| 13 | 86 | 88 | 92 | 93 | 92 | 90.2 |

| 14 | 88 | 91 | 95 | 93 | 97 | 92.8 |

| 15 | 90 | 93 | 96 | 93 | 100 | 94.4 |

| 16 | 93 | 94 | 98 | 93 | 102 | 96 |

| 17 | 95 | 96 | 100 | 93 | 104 | 97.59 |

| 18 | 97 | 98 | 101 | 93 | 106 | 99 |

| 19 | 100 | 98 | 101 | 93 | 106 | 99.59 |

| 20 | 102 | 98 | 101 | 93 | 106 | 100 |

CRJ700 Captain Hourly Rate

| Years of Service | Mesa Airlines | Envoy Air | GoJet Airlines | Skywest Airlines | Average |

|---|---|---|---|---|---|

| 1 | 62 | 68 | 69 | 67 | 66.5 |

| 2 | 64 | 70 | 71 | 70 | 68.75 |

| 3 | 65 | 73 | 73 | 73 | 71 |

| 4 | 67 | 75 | 76 | 75 | 73.25 |

| 5 | 69 | 77 | 78 | 77 | 75.25 |

| 6 | 71 | 79 | 80 | 80 | 77.5 |

| 7 | 73 | 81 | 83 | 82 | 79.75 |

| 8 | 75 | 83 | 85 | 84 | 81.75 |

| 9 | 77 | 86 | 88 | 87 | 84.5 |

| 10 | 80 | 88 | 91 | 90 | 87.25 |

| 11 | 82 | 91 | 94 | 93 | 90 |

| 12 | 84 | 94 | 97 | 96 | 92.75 |

| 13 | 87 | 97 | 100 | 99 | 95.75 |

| 14 | 89 | 100 | 103 | 102 | 98.5 |

| 15 | 92 | 101 | 106 | 105 | 101 |

| 16 | 93 | 103 | 108 | 108 | 103 |

| 17 | 95 | 105 | 111 | 111 | 105.5 |

| 18 | 96 | 106 | 114 | 114 | 107.5 |

| 19 | 98 | 106 | 114 | 116 | 108.5 |

| 20 | 99 | 106 | 114 | 118 | 109.25 |

CRJ900 Captain Hourly Rate

| Years of Service | Mesa Airlines | Envoy Air | GoJet Airlines | Skywest Airlines | Average |

|---|---|---|---|---|---|

| 1 | 62 | 68 | 69 | 67 | 66.5 |

| 2 | 64 | 70 | 71 | 70 | 68.75 |

| 3 | 65 | 73 | 73 | 73 | 71 |

| 4 | 67 | 75 | 76 | 75 | 73.25 |

| 5 | 69 | 77 | 78 | 77 | 75.25 |

| 6 | 71 | 79 | 80 | 80 | 77.5 |

| 7 | 73 | 81 | 83 | 82 | 79.75 |

| 8 | 75 | 83 | 85 | 84 | 81.75 |

| 9 | 77 | 86 | 88 | 87 | 84.5 |

| 10 | 80 | 88 | 91 | 90 | 87.25 |

| 11 | 82 | 91 | 94 | 93 | 90 |

| 12 | 84 | 94 | 97 | 96 | 92.75 |

| 13 | 87 | 97 | 100 | 99 | 95.75 |

| 14 | 89 | 100 | 103 | 102 | 98.5 |

| 15 | 92 | 101 | 106 | 105 | 101 |

| 16 | 93 | 103 | 108 | 108 | 103 |

| 17 | 95 | 105 | 111 | 111 | 105.5 |

| 18 | 96 | 106 | 114 | 114 | 107.5 |

| 19 | 98 | 106 | 114 | 116 | 108.5 |

| 20 | 99 | 106 | 114 | 118 | 109.25 |

E175 Captain Hourly Rate

| Years of Service | Mesa Airlines | Republic Airline | Compass Airlines | Envoy Air | Horizon Air | Skywest Airlines | Average |

|---|---|---|---|---|---|---|---|

| 1 | 63 | 77 | 73 | 68 | 70 | 68 | 69.83 |

| 2 | 65 | 79 | 76 | 70 | 72 | 70 | 72 |

| 3 | 67 | 81 | 78 | 73 | 74 | 74 | 74.5 |

| 4 | 69 | 84 | 80 | 75 | 77 | 76 | 76.83 |

| 5 | 71 | 86 | 83 | 77 | 79 | 78 | 79 |

| 6 | 73 | 88 | 85 | 79 | 81 | 81 | 81.16 |

| 7 | 75 | 91 | 88 | 81 | 84 | 83 | 83.66 |

| 8 | 77 | 93 | 91 | 83 | 87 | 85 | 86 |

| 9 | 79 | 96 | 94 | 86 | 90 | 88 | 88.83 |

| 10 | 81 | 98 | 97 | 88 | 94 | 91 | 91.5 |

| 11 | 84 | 101 | 100 | 91 | 97 | 94 | 94.5 |

| 12 | 86 | 104 | 103 | 94 | 100 | 97 | 97.33 |

| 13 | 89 | 107 | 106 | 97 | 103 | 100 | 100.33 |

| 14 | 91 | 110 | 108 | 100 | 106 | 103 | 103 |

| 15 | 94 | 113 | 111 | 101 | 109 | 106 | 105.66 |

| 16 | 96 | 116 | 114 | 103 | 112 | 109 | 108.33 |

| 17 | 98 | 120 | 116 | 105 | 116 | 112 | 111.16 |

| 18 | 100 | 123 | 119 | 106 | 119 | 115 | 113.66 |

| 19 | 102 | 126 | 119 | 106 | 119 | 117 | 114.83 |

| 20 | 105 | 129 | 119 | 106 | 119 | 119 | 116.16 |

Regional Jet First Officer Pay

CRJ200 First Officer Hourly Rate

| Years of Service | Endeavor Air | Express Jet | PSA Airlines | Air Wisconsin | Skywest Airlines | Average |

|---|---|---|---|---|---|---|

| 1 | 50 | 37 | 39 | 36 | 37 | 39.8 |

| 2 | 56 | 38 | 40 | 42 | 39 | 43 |

| 3 | 60 | 40 | 40 | 44 | 41 | 45 |

| 4 | 61 | 41 | 40 | 45 | 42 | 45.8 |

| 5 | 63 | 43 | 40 | 46 | 44 | 47.2 |

| 6 | 64 | 44 | 40 | 48 | 45 | 48.2 |

| 7 | 65 | 45 | 40 | 49 | 46 | 49 |

| 8 | 65 | 46 | 40 | 51 | 48 | 50 |

EMB145 First Officer Hourly Rate

| Years of Service | CommutAir | Express Jet | Envoy Air | Piedmont | Trans States Airlines | Average |

|---|---|---|---|---|---|---|

| 1 | 36 | 37 | 38 | 39 | 36 | 37.2 |

| 2 | 39 | 38 | 40 | 42 | 39 | 39.6 |

| 3 | 40 | 38 | 41 | 42 | 41 | 40.4 |

| 4 | 41 | 40 | 42 | 42 | 42 | 41.4 |

| 5 | 43 | 42 | 42 | 42 | 43 | 42.4 |

| 6 | 44 | 43 | 42 | 42 | 44 | 43 |

| 7 | 44 | 44 | 42 | 42 | 44 | 43.2 |

| 8 | 44 | 45 | 43 | 42 | 44 | 43.6 |

CRJ700 First Officer Hourly Rate

| Years of Service | Mesa Airlines | Envoy Air | GoJet Airlines | Skywest Airlines | Average |

|---|---|---|---|---|---|

| 1 | 36 | 38 | 37 | 37 | 37 |

| 2 | 38 | 40 | 39 | 41 | 39.5 |

| 3 | 38 | 41 | 41 | 43 | 40.75 |

| 4 | 38 | 42 | 42 | 45 | 41.75 |

| 5 | 39 | 42 | 44 | 46 | 42.75 |

| 6 | 41 | 42 | 45 | 48 | 44 |

| 7 | 42 | 42 | 45 | 49 | 44.5 |

| 8 | 43 | 43 | 45 | 50 | 45.25 |

| 9 | 44 | 43 | 45 | 50 | 45.5 |

| 10 | 45 | 43 | 45 | 50 | 45.75 |

| 11 | 47 | 43 | 45 | 50 | 46.25 |

| 12 | 49 | 43 | 45 | 50 | 46.75 |

| 13 | 50 | 43 | 45 | 50 | 47 |

| 14 | 51 | 43 | 45 | 50 | 47.25 |

| 15 | 52 | 43 | 45 | 50 | 47.5 |

CRJ900 First Officer Hourly Rate

| Years of Service | Endeavor Air | Express Jet | Mesa Airlines | GoJet Airlines | Skywest Airlines | Average |

|---|---|---|---|---|---|---|

| 1 | 50 | 40 | 36 | 37 | 37 | 40 |

| 2 | 59 | 41 | 38 | 39 | 42 | 43.8 |

| 3 | 62 | 42 | 38 | 41 | 44 | 45.4 |

| 4 | 63 | 43 | 38 | 42 | 46 | 46.4 |

| 5 | 66 | 44 | 39 | 44 | 47 | 48 |

| 6 | 67 | 46 | 41 | 45 | 48 | 49.4 |

| 7 | 67 | 47 | 42 | 45 | 50 | 50.2 |

| 8 | 67 | 48 | 43 | 45 | 51 | 50.8 |

| 9 | 67 | 48 | 44 | 45 | 51 | 51 |

| 10 | 67 | 48 | 45 | 45 | 51 | 51.2 |

| 11 | 67 | 48 | 47 | 45 | 51 | 51.6 |

| 12 | 67 | 48 | 49 | 45 | 51 | 52 |

| 13 | 67 | 48 | 50 | 45 | 51 | 52.2 |

| 14 | 67 | 48 | 51 | 45 | 51 | 52.4 |

| 15 | 67 | 48 | 52 | 45 | 51 | 52.6 |

E175 First Officer Hourly Rate

| Years of Service | Mesa Airlines | Republic Airline | Compass Airlines | Envoy Air | Horizon Air | Skywest Airlines | Average |

|---|---|---|---|---|---|---|---|

| 1 | 36 | 45 | 41 | 38 | 40 | 37 | 39.5 |

| 2 | 38 | 50 | 42 | 40 | 46 | 41 | 42.83 |

| 3 | 38 | 51 | 45 | 41 | 47 | 44 | 44.33 |

| 4 | 38 | 52 | 46 | 42 | 48 | 45 | 45.16 |

| 5 | 39 | 53 | 48 | 42 | 49 | 46 | 46.16 |

| 6 | 41 | 54 | 49 | 42 | 50 | 48 | 47.33 |

| 7 | 42 | 55 | 50 | 42 | 51 | 49 | 48.16 |

| 8 | 43 | 56 | 51 | 43 | 52 | 51 | 49.33 |

| 9 | 44 | 57 | 51 | 43 | 52 | 51 | 49.66 |

| 10 | 45 | 57 | 51 | 43 | 52 | 51 | 49.83 |

| 11 | 47 | 57 | 51 | 43 | 52 | 51 | 50.16 |

| 12 | 49 | 57 | 51 | 43 | 52 | 51 | 50.5 |

| 13 | 50 | 57 | 51 | 43 | 52 | 51 | 50.66 |

| 14 | 51 | 57 | 51 | 43 | 52 | 51 | 50.83 |

| 15 | 52 | 57 | 51 | 43 | 52 | 51 | 51 |

US Airlines Regional Jet Fleets

Bombardier Regional Jet Fleets

| CRJ200 | CRJ700 | CRJ900 | |

|---|---|---|---|

| Endeavor Air | 42 | 3 | 109 |

| ExpressJet | - | 34 | - |

| Mesa Airlines | 1 | 20 | 64 |

| PSA Airlines | 35 | 39 | 54 |

| Air Wisconsin | 65 | - | - |

| Envoy Air | - | 26 | - |

| GoJet Airlines | - | 47 | 7 |

| SkyWest Airlines | 201 | 84 | 36 |

Embraer Regional Jet Fleets

| EMB Family | E-Jet 170/175 | |

|---|---|---|

| CommutAir | 27 | - |

| ExpressJet | 136 | - |

| Mesa Airlines | - | 60 |

| Republic Airlines | - | 189 |

| Envoy Air | 107 | 44 |

| Horizon Air | - | 15 |

| Piedmont Airlines | 48 | - |

| SkyWest Airlines | - | 114 |

| Trans States Airlines | 63 | - |

Regional Jet Orders

| CRJ700 | CRJ900 | EMB Family | E-Jet 170/175 | MRJ | |

|---|---|---|---|---|---|

| CommutAir | - | - | 37 | - | - |

| PSA Airlines | 21 | 15 | - | - | - |

| Republic Airlines | - | - | - | 18 | - |

| Envoy Air | - | - | 15 | 25 | - |

| Horizon Air | - | - | - | 18 | - |

| SkyWest Airlines | 18 | 20 | - | 114 | 100 |

| Trans States Airlines | - | - | - | - | 20 |

Greg started his professional pilot journey in 2002 after graduating from Embry Riddle. Since that time he has accumulated over 8,000 hours working as a pilot. Greg’s professional experience includes flight instructing, animal tracking, backcountry flying, forest firefighting, passenger charter, part 135 cargo, flying for a regional airline, a national low cost airline, a legacy airline, and also working as a manager in charge of Part 135 and Part 121 training programs.